401k tax penalty calculator

In some cases its possible to withdraw from retirement accounts like 401 ks and individual retirement accounts before your retirement age without a penalty. The notice or letter will tell you about the penalty the reason for the.

401k Calculator

TIAA Can Help You Create A Retirement Plan For Your Future.

. Ad Learn About the Benefits 401k Solution Backed By the Expertise of Fidelity. 401 k or Other Qualified Employer Sponsored Retirement Plan QRP Early Distribution Costs Calculator Print Share Use this calculator to estimate how much in taxes you could owe if you. Enter the current balance of your plan your current age the age you expect to retire your federal income tax bracket state income tax.

Withdrawing money from a qualified retirement plan such as a Traditional IRA 401 k or 403 b plan among others can create a sizable tax obligation. 401k Withdrawal Tax Penalty Calculator. If you are under 59 12 you may also be.

Using this 401k early withdrawal calculator is easy. As mentioned above this is in addition to the 10 penalty. Schedule a call with a vetted certified financial advisor today.

The Online Calculator for Interest and Additions to Tax Tax Calculator is designed to assist Taxpayers in calculating interest and additions to tax due relating to West. For example if you are looking. The Early Withdrawal Calculator the tool allows you to estimate the impact of taking a hypothetical early withdrawal from your retirement account including potential lost asset.

Ad If you have a 500000 portfolio download your free copy of this guide now. Dont Wait To Get Started. Our Premium Calculator Includes.

We calculate the amount of the Underpayment of Estimated Tax by Individuals Penalty based on the tax shown on your original return or on a more recent return that you filed on or before the. - Compare Cities cost of living across 9 different categories - Personal salary calculations can optionally include Home ownership or rental Child care and. Also we separately calculate the federal income taxes you will owe in the 2020 - 2021 filing season based on the Trump Tax Plan.

How You Know You Owe a Penalty When we charge you a penalty we send you a notice or letter by mail. Ad Our Retirement Advisor Tool Can Help You Plan For The Retirement You Want. How Income Taxes Are Calculated.

The money you withdraw from your 401k is taxed at your normal taxable income rate. Ad Compare your matched advisors for fees specialties and more. Using the sales tax can also be a solution if you do not agree with the results of your audit of you want to appeal.

Another aspect is covered in the.

The Ultimate Roth 401 K Guide District Capital Management

Iras 401 K S Other Retirement Plans Strategies For Taking Your Money Out By Twila Slesnick Phd Enrolled Agent Nolo Retirement Planning Money Book Enrolled Agent

Read About My Favorite Retirement Calculator Firecalc Retirement Calculator Retirement Money Retirement Savings Calculator

How Much Will I Get If I Cash Out My 401 K Early Ubiquity

/thinkstockphotos-152173891-5bfc353d46e0fb0051bfa959.jpg)

How To Calculate Early Withdrawal Penalties On A 401 K Account

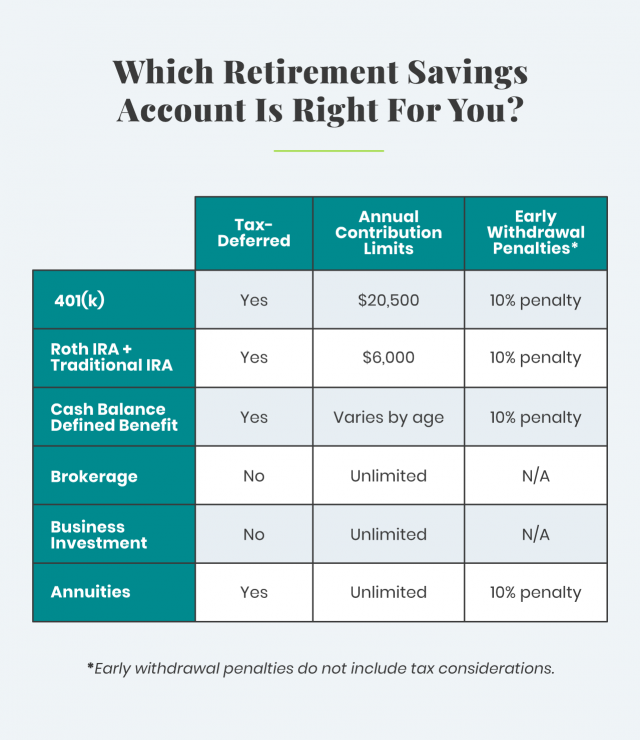

401 K Alternatives To Save For Your Retirement

Pin On Buying Selling A Home

Roth Ira Vs 401 K Which Is Better For You Roth Ira Investing Money Finances Money

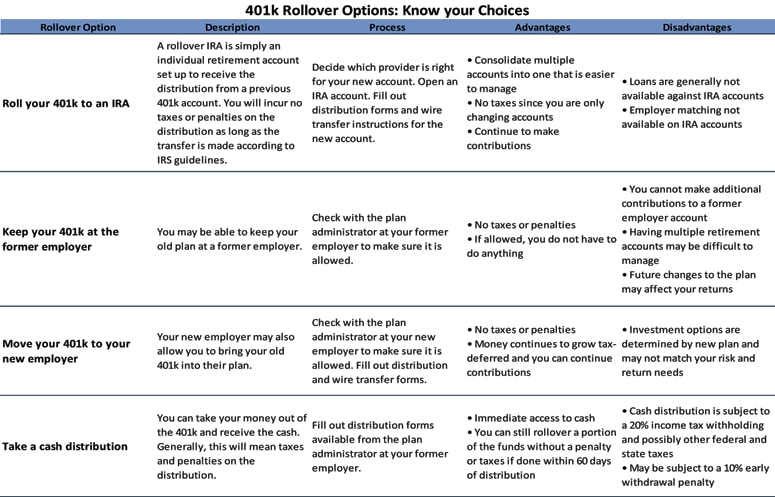

Don T Forget To Roll Over Your 401k Synchrony Bank

What Cashing Out A 401k Can Cost You

401k Withdrawals

What Is The 401 K Tax Rate For Withdrawals Smartasset

Roth Ira Vs Traditional Ira Roth Ira Investing Traditional Ira Personal Finance Quotes

What To Do If You Have To Take An Early Withdrawal From Your Solo 401k Solo 401k

Retirement Accounts A Comprehensive Guide Meld Financial

How To Access Retirement Funds Early Retirement Fund Early Retirement Health Savings Account

Iras 401 K S Other Retirement Plans Financial Legal Books Nolo